reverse sales tax calculator ontario

Enter that total price into Price including HST input box at the bottom of calculator and you will get excluding HST value and HST value. This valuable tool has been updated for with latest figures and rules for working out taxes.

Daha Fazla Havalandirma Yuk Vagonu Reverse Sales Tax Calculator Adventuregalleyfinds Com

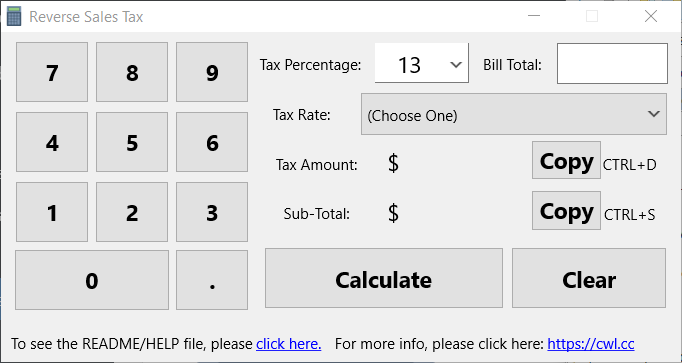

The second script is the reverse of the first.

. Province of Sale Select the province where the product buyer is located. Tax Amount Original Cost - Original Cost 100 100 GST or HST or PST Amount without Tax Amount with Taxes - Tax Amount. All Harmonized Sales Tax calculators on this site can be used as well as reverse HST calculator.

Following is the reverse sales tax formula on how to calculate reverse tax. Any input field can be used. That entry would be 0775 for the percentage.

Current Provincial Sales Tax PST rates are. Reverse Sales Tax Calculator. Reverse Sales Tax Formula.

An 8 provincial sales tax and a 5 federal. If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043That means that your net pay will be 37957 per year or 3163 per month. If you know the total sales price and the sales tax percentage it will calculate the base price before taxes and the amount of sales tax that was in the total price.

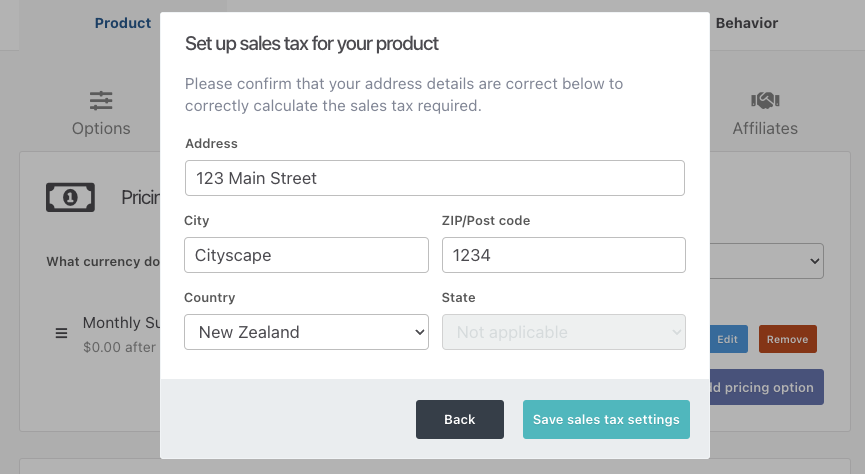

Enter HST inclusive price and calculate reverse HST value and Harmonized sales tax exclusive price. Select the province you need to calculate HST for and then enter any value you know HST value OR price including HST OR price exclusive HST the other values will be calculated instantly. To calculate the subtotal amount and sales taxes from a total.

Instead of using the reverse sales tax calculator you can compute this manually. Calculate the total income taxes of the Ontario residents for 2021. How to Calculate Reverse Sales Tax.

Formula for calculating reverse GST and PST in BC. 13 for Ontario 15 for others. Where the supply is made learn about the place of supply rules.

Income Tax Calculator Ontario 2021. This calculator will help you get the net tax income after tax the percentage of tax of each government provincial and federal and all the contributions CPP and EI. The given number will be the pre-HST number that will be calculated.

The period reference is from january 1st 2021 to december 31 2021. Sales Tax Calculator Omni Calculator. Claims are based on aggregated sales data for all NETFILE tax year 2020 TurboTax products.

To find the original price of an item you need this formula. Enter price without HST HST value and price including HST will be calculated. The HST is applied to most goods and services although there are some categories that are exempt or rebated from the HST.

The only thing to remember about claiming sales tax and tax forms is to save every receipt for every purchase you intend to claim. Enter HST value and get HST inclusive and HST exclusive prices. Northwest Territories Nunavut and Yukon have no territorial sales tax at all.

Margin of error for HST sales tax. Need to calculate sales tax in Canada. This is particularly useful if you sell merchandise on a tax included basis and then must determine how much.

Ensure that the Find Subtotal before tax tab is selected. The County sales tax rate is. The Ontario sales tax rate is.

It is very easy to use it. Calculates the canada reverse sales taxes HST GST and PST. The reverse sales tax calculator exactly as you see it above is 100 backtrack time calculator.

This simple PST calculator will help to calculate PST or reverse PST. Just set it to the HST province that you want to reverse and enter in the after-tax dollar amount that you want to reverse. OP with sales tax OP tax rate in decimal form 1.

Type of supply learn about what supplies are taxable or not. This is the total of state county and city sales tax rates. Calculates the canada reverse sales taxes hst gst and pst.

The HST was adopted in Ontario on July 1st 2010. This is very simple universal HST calculator for any Canadian province where Harmonized Sales Tax is used. The California sales tax rate is currently.

Ontariotaxcalculator is a simple efficient and easy to use tool in ontario to calculate sales tax hst. GSTHST provincial rates table. Who the supply is made to to learn.

The following table provides the GST and HST provincial rates since July 1 2010. 13 rows Harmonized Sales Tax HST The Harmonized Sales Tax or HST is a sales tax that is. Due to rounding of the amount without sales tax it is possible that the method of reverse calculation charges does not give 001 to close the total of sales tax used in every businesses.

In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax. This is very simple HST calculator for Ontario province. An error margin of 001 may appear in reverse calculator of Canada HST GST and PST sales tax.

The rate you will charge depends on different factors see. So if you push temp onto results without How do I calculate sales tax in Ontario. Does not include calculation errors due to errors in CRA tables.

If you want a reverse HST calculator the above tool will do the trick. Amount with sales tax 1 GST and PST rate combined100 Amount without sales tax Amount with sales taxes x GST rate100 Amount of GST in BC. Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase.

The HST is made up of two components. There are times when you may want to find out the original price of the items youve purchased before tax. You have a total price with HST included and want to find out a price without Harmonized Sales Tax.

This calculator can be used as well as reverse HST calculator. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. HST Tax Rate.

New brunswick newfoundland and labrador nova scotia ontario and prince edward island. A Reverse Sales Tax Calculator is useful if you itemize your deductions and claim overpaid local and out-of-state sales taxes on your taxes. Press Calculate and youll see the tax amounts as well as the grand total subtotal taxes appear in the fields below.

Ontario is one of the provinces in Canada that charges a Harmonized Sales Tax HST of 13. Amount without sales taxes x PST rate100 Amount of PST in BC. Reverse GST HST PST QST Calculator 2022.

The minimum combined 2022 sales tax rate for Ontario California is. If you pay a penalty or interest due to a TurboTax calculation error we will reimburse the penalty and interest. Your average tax rate is 270 and your marginal tax rate is 353This marginal tax rate means that your immediate additional income will be taxed at this rate.

Price Before Tax Final Price 1Sales Tax100 Tax Amount Final Price - Price Before Tax.

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price

Ontario Sales Tax Hst Calculator 2022 Wowa Ca

Pst Calculator Calculatorscanada Ca

Daha Fazla Havalandirma Yuk Vagonu Reverse Sales Tax Calculator Adventuregalleyfinds Com

Reverse Gst Hst Pst Qst Calculator 2022 All Provinces In Canada

Daha Fazla Havalandirma Yuk Vagonu Reverse Sales Tax Calculator Adventuregalleyfinds Com

How To Calculate Sales Tax Backwards From Total

Reverse Hst Calculator Hstcalculator Ca

Reverse Sales Tax Calculator 100 Free Calculators Io

Daha Fazla Havalandirma Yuk Vagonu Reverse Sales Tax Calculator Adventuregalleyfinds Com

Daha Fazla Havalandirma Yuk Vagonu Reverse Sales Tax Calculator Adventuregalleyfinds Com

Washington Dc Sales Tax Calculator Reverse Sales Dremployee

How To Calculate Sales Tax Backwards From Total

Daha Fazla Havalandirma Yuk Vagonu Reverse Sales Tax Calculator Adventuregalleyfinds Com

Daha Fazla Havalandirma Yuk Vagonu Reverse Sales Tax Calculator Adventuregalleyfinds Com